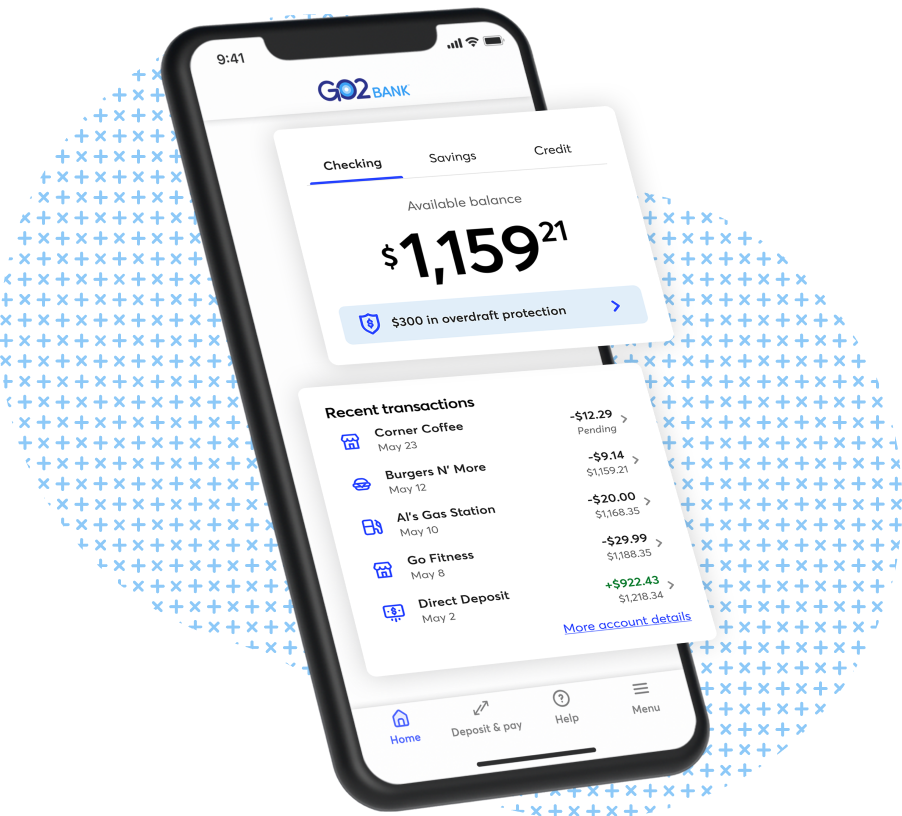

All your banking needs, all in one app

Security

Cash deposits

Check cashing

Free ATMs

Cash back

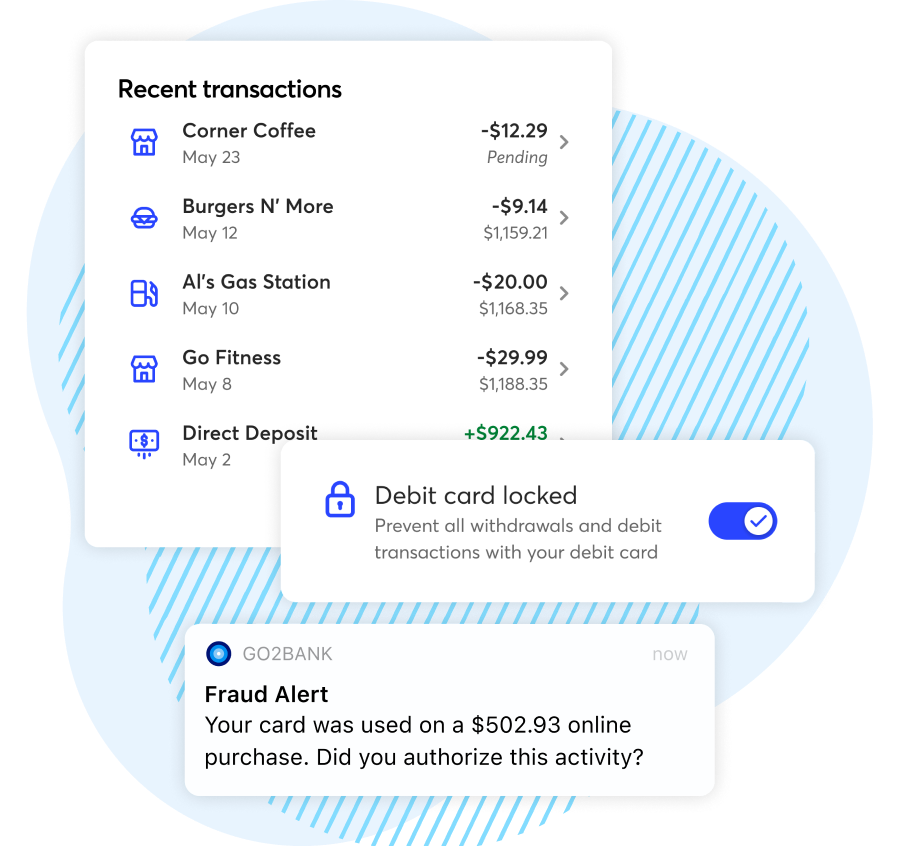

Keep your money safe

Keep your money safe

Check your transactions, set up fraud alerts, lock or unlock your card, and chat with agent, all right from the app.

Check your transactions, set up fraud alerts, lock or unlock your card, and chat with agent, all right from the app.

Deposit cash on the go

Deposit cash on the go

Forgot your card? Just use the app to deposit cash with a barcode at thousands of retail stores nationwide.

Forgot your card? Just use the app to deposit cash with a barcode at thousands of retail stores nationwide.

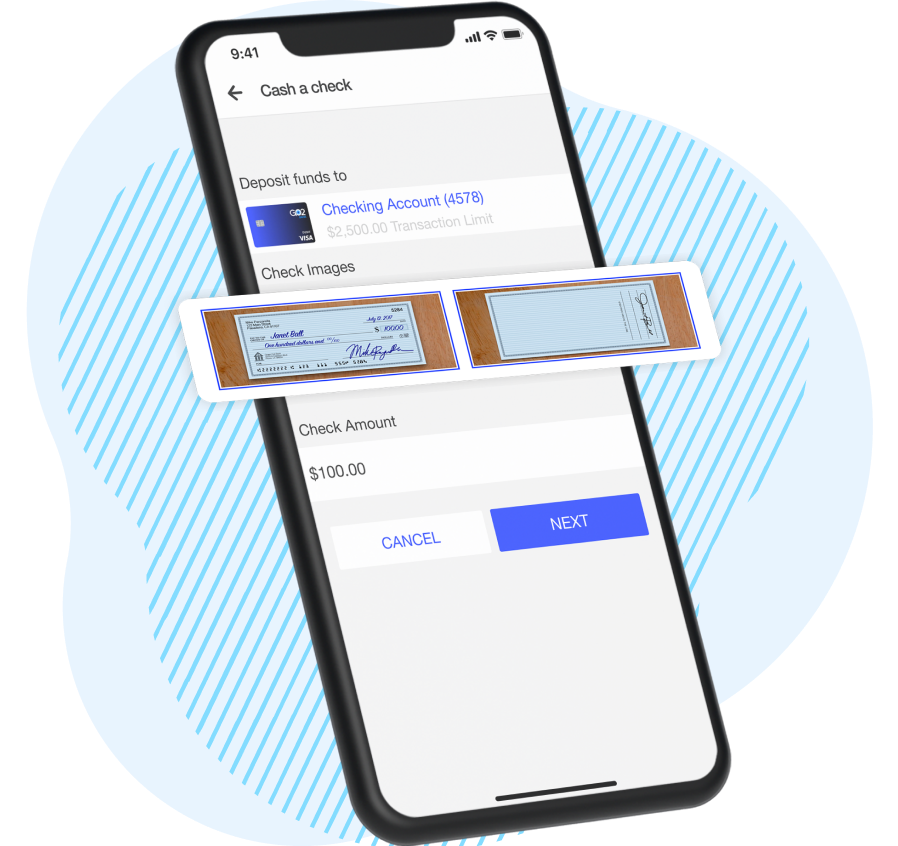

Cash checks from anywhere

Cash checks from anywhere

Just snap a pic on your phone to cash a check wherever, whenever. All you need is the GO2bank app.** Activated, chip-enabled debit card required to use Ingo Money check cashing service. The check cashing service is provided by Ingo Money, Inc. and the sponsor bank, identified in the terms and conditions for the service and subject to Ingo Money Inc. Terms and Conditions and Privacy Policy. Limits apply. Approval usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money's sole discretion. Fees apply for approved Money in Minutes transactions funded to your account. Unapproved checks will not be funded to your account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See Deposit Account Agreement (PDF) for details. Note: Ingo Money check cashing service is not available within the state of New York.

Just snap a pic on your phone to cash a check wherever, whenever. All you need is the GO2bank app.** Activated, chip-enabled debit card required to use Ingo Money check cashing service. The check cashing service is provided by Ingo Money, Inc. and the sponsor bank, identified in the terms and conditions for the service and subject to Ingo Money Inc. Terms and Conditions and Privacy Policy. Limits apply. Approval usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money's sole discretion. Fees apply for approved Money in Minutes transactions funded to your account. Unapproved checks will not be funded to your account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See Deposit Account Agreement (PDF) for details. Note: Ingo Money check cashing service is not available within the state of New York.

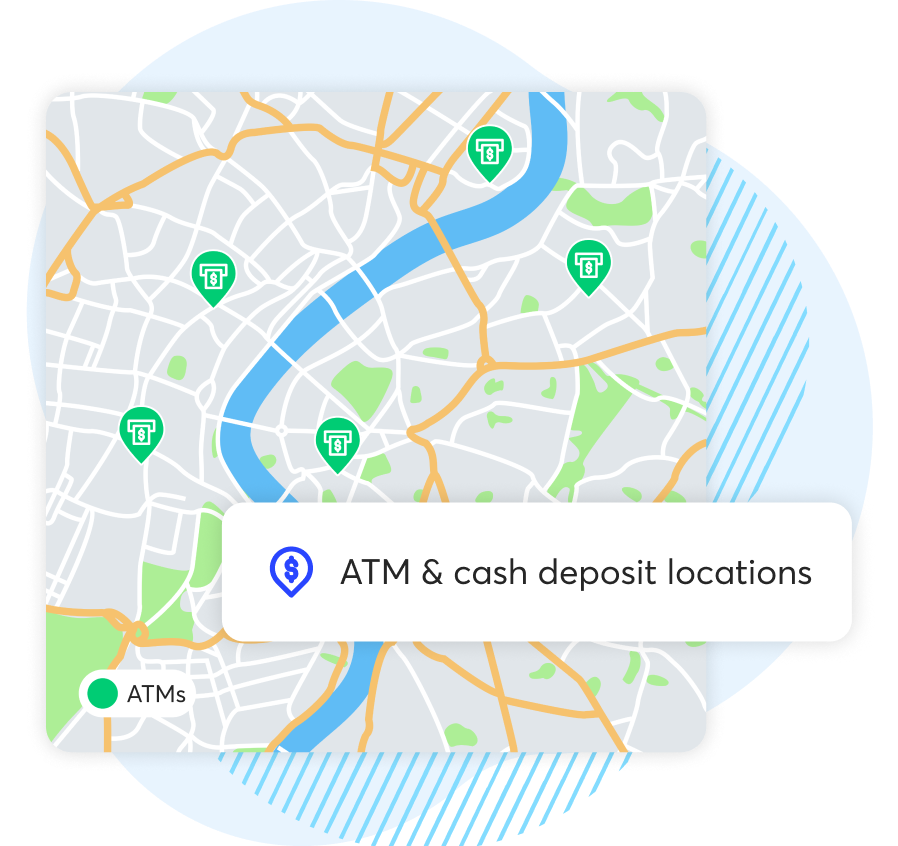

Withdraw cash for free nationwide

Withdraw cash for free nationwide

Use the app to help you get your cash for free quickly and easily with our fee-free nationwide ATM network.

Use the app to help you get your cash for free quickly and easily with our fee-free nationwide ATM network.

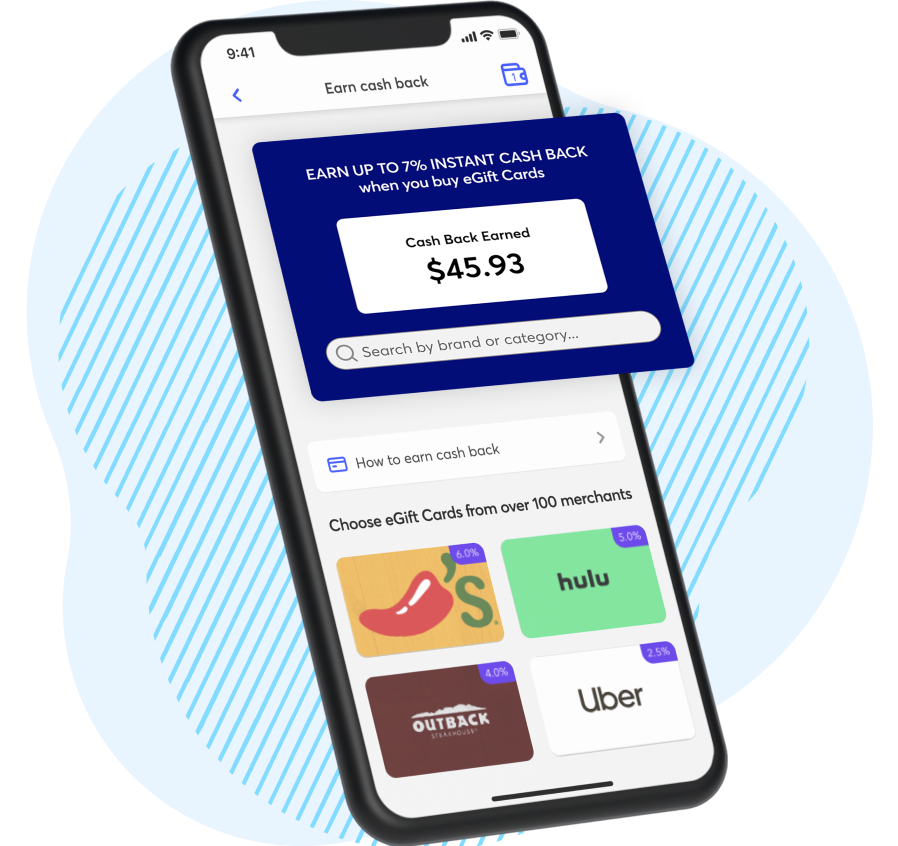

Earn up to 7% instant cash back

Earn up to 7% instant cash back

Get up to 7% instant cash back when you purchase eGift Cards from over 100 popular merchants in the app.

Get up to 7% instant cash back when you purchase eGift Cards from over 100 popular merchants in the app.

“I am 100% satisfied. The app has worked flawlessly and is the best app I have used for online banking. I highly recommend GO2bank.”

“I am 100% satisfied. The app has worked flawlessly and is the best app I have used for online banking. I highly recommend GO2bank.”

- Bob Sr.** Testimonials shown are received through various channels, and are applicable to the individual who wrote it. Experiences may not be representative of others’ experiences. Statements are displayed as written, except for grammatical or typing error corrections. Some may be edited for clarity or shortened to exclude extraneous information. No compensation, products, services, or other benefits were provided in exchange for testimonials.

Help

Help